Sustainable Development Goals

Climate Change Engagement

Why Does Outsourcing Make Sense for Non-Profit Investment Portfolios?

Non-profit fiduciaries are facing some tough challenges. Increased competition for donor dollars, tighter budgets, slimmer staff resources and reductions in government funding are all putting pressure on the ability of non-profit organizations to meet their spending commitments. Add to this the mounting demands on community support, scholarships, grants, etc. that many organizations are facing – and you have a sector working hard to support the needs of their communities with dwindling resources.

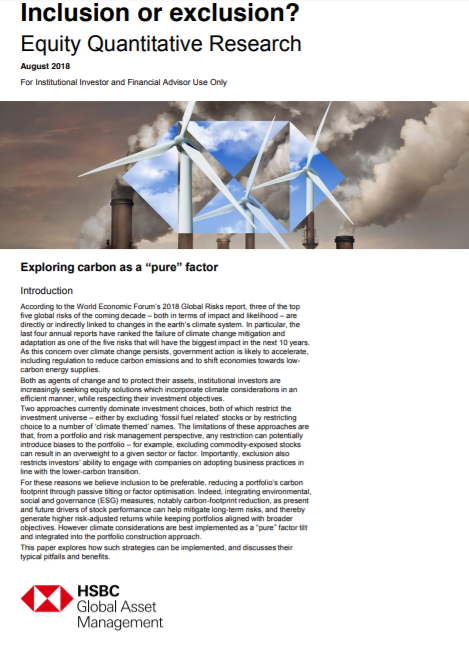

Inclusion or Exclusion? Equity Quantitative Research

Exploring carbon as a “pure” factor

Investors are seeking equity solutions that incorporate climate considerations. Reducing a portfolio’s carbon footprint by exclusion is a blunt approach. We prefer factor optimization in multi-factor portfolios, which can generate higher risk-adjusted returns while keeping portfolios aligned with broader climate objectives.

The Rise of ESG Disclosure and What It Means for You

Cidel Asset Management

Environmental, Social, and Governance (ESG) information has received increased attention from investors in recent years. As of 2017, 75% of major companies around the world produced some form of Corporate Social Responsibility (CSR) report, up from 19% in 2002; this report is the most important source of a company’s ESG data. While the increased disclosure of information leads to added transparency, the additional information is not always pertinent to equity performance forecasts. In this vast array of information, how can an investor determine what is relevant?

In these articles, Cidel Asset Management explores the Rise of ESG disclosures and takes a closer look at why Corporate Governance matters.

Sustainable Investing Provides High Value For Investors

ESG Investing Is Increasingly A Mainstream Investment Practice: Institutional investors are progressively more aware of the benefits of incorporating the analysis of environmental, social and governance (ESG) factors into their investment decision making. Learn more about ESG investing and why it is becoming an increasingly mainstream investment practice.

The Relevance Of Gold As A Strategic Asset

Gold is a highly liquid yet scarce asset, and it is no one’s liability. It is bought as a luxury good as much as an investment. As such, gold can play four fundamental roles in a portfolio:

- a source of long-term returns

- a diversifier that can mitigate losses in times of market

stress - a liquid asset with no credit risk that has outperformed fiat

currencies - a means to enhance overall portfolio performance.

Our analysis shows that adding 2%, 5% or 10% in gold over the past decade to the average pension fund portfolio would have both increased returns and reduced volatility, resulting in higher risk-adjusted returns.

Silver Heights – The Perspective

Rational, independent thinkingᵀᴹ

Our investment philosophy and operating principles are fundamental to who we are as investors. To give people deeper insights into how we think about risk and investing, we introduced our newsletter, The Perspective, shortly after we started Silver Heights in 2006. These aren’t market commentaries, but rather, articles written to provide insights into our approach to preserving and growing capital.

On the occasion of the 16th annual Foundation, Endowment and Not for Profit Investment Summit, Sliver Heights has gathered three of our favourite Perspectives for you:

- “Investment First”

- “Do You Have the Right Heroes?”

- “Don’t Judge a Book by Its Cover”

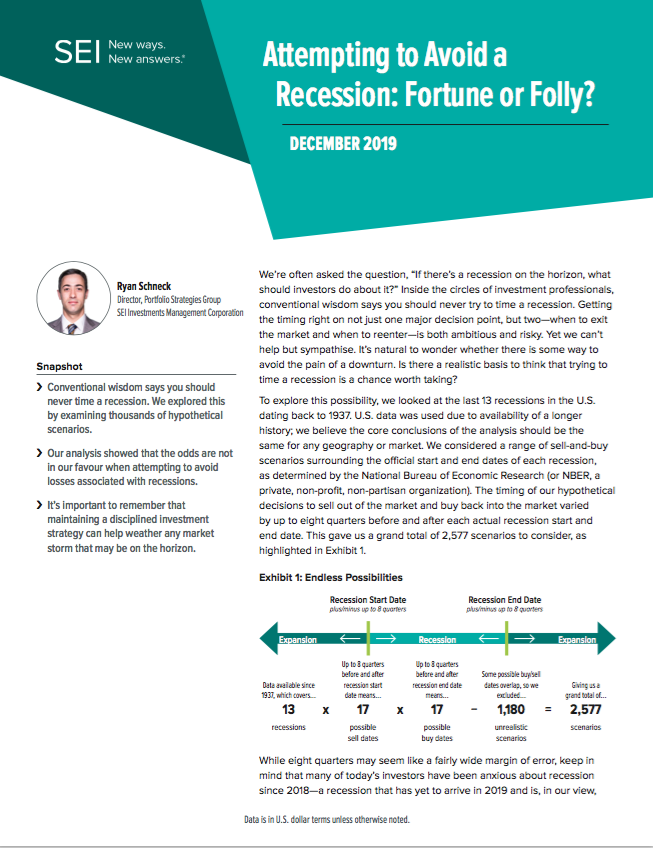

Attempting to Avoid a Recession: Fortune or Folly?

We’re often asked the question, “If there’s a recession on the horizon, what should investors do about it?” Inside the circles of investment professionals, conventional wisdom says you should never try to time a recession. Getting the timing right on not just one major decision point, but two—when to exit the market and when to reenter—is both ambitious and risky. Yet we can’t help but sympathise. It’s natural to wonder whether there is some way to avoid the pain of a downturn. Is there a realistic basis to think that trying to time a recession is a chance worth taking?